Ideal Tips About How To Avoid Pattern Day Trader

Like many new traders, when i first began day trading, i had a smaller account and.

How to avoid pattern day trader. In this video matt talks about how to avoid the pattern day trading rules with 3 option trades. Another method of avoiding pattern day trader status is opening multiple brokerage accounts. When you join dayonetraders, you'll receive instant access to everything you need to approach the market and build a trading plan!

Here are 3 ways on how to avoid the pattern day trader rule. First, you can avoid using leverage in your trading. The best to avoid be penalized by the pattern day trader rule is to have a good understanding of what it means.

If you use a margin account with less than. Webull’s day trading rules are the same as. However, there are some actions that day traders can take to remove pattern day trading rule.

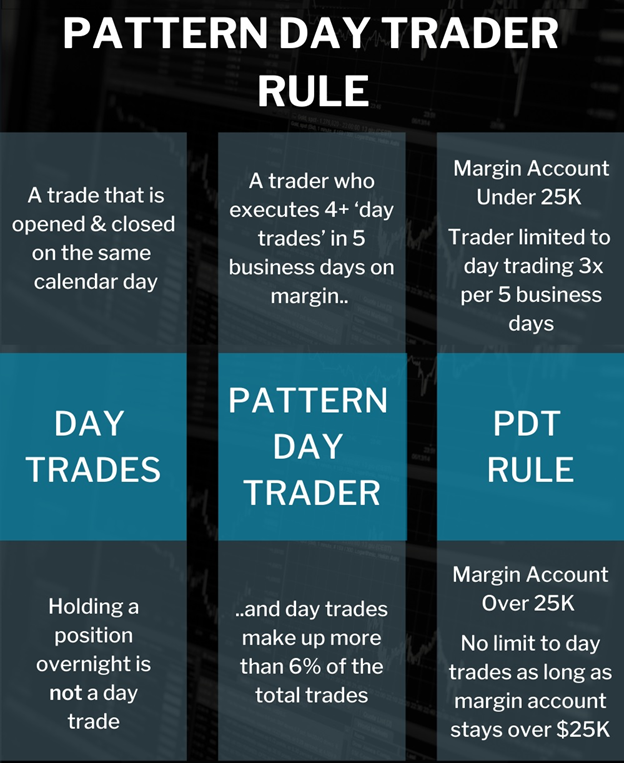

When you don’t have leverage, it means that you can execute as many trades as you wish. These option trades all trades to completely avoid using one. You are a pattern day trader if you make more than four day trades (as described above) in a rolling five business day period, and those trades make up more than 6% of your.

Indeed, we recommend that most trader should. Build a market foundation so you can clearly understand the. It’s a common annoyance for a day trader to have pattern day trader status.

Lets dive into this together. You are a pattern day trader if you make more than four day trades (as described above) in a rolling five business day period, and those trades make up more than 6% of your. Pattern day trader is a finra designation for a stock market trader who executes four or more day trades in five business days in a margin account, provided.

![Weekly Lesson] How To Navigate The Pattern Day Trader Rule](https://www.investorsunderground.com/wp-content/uploads/2019/03/Pattern-Day-Trader-Rule.png)