Lessons I Learned From Info About How To Reduce Credit Card Interest Rates

Typically, issuers will sell unpaid debts to collection.

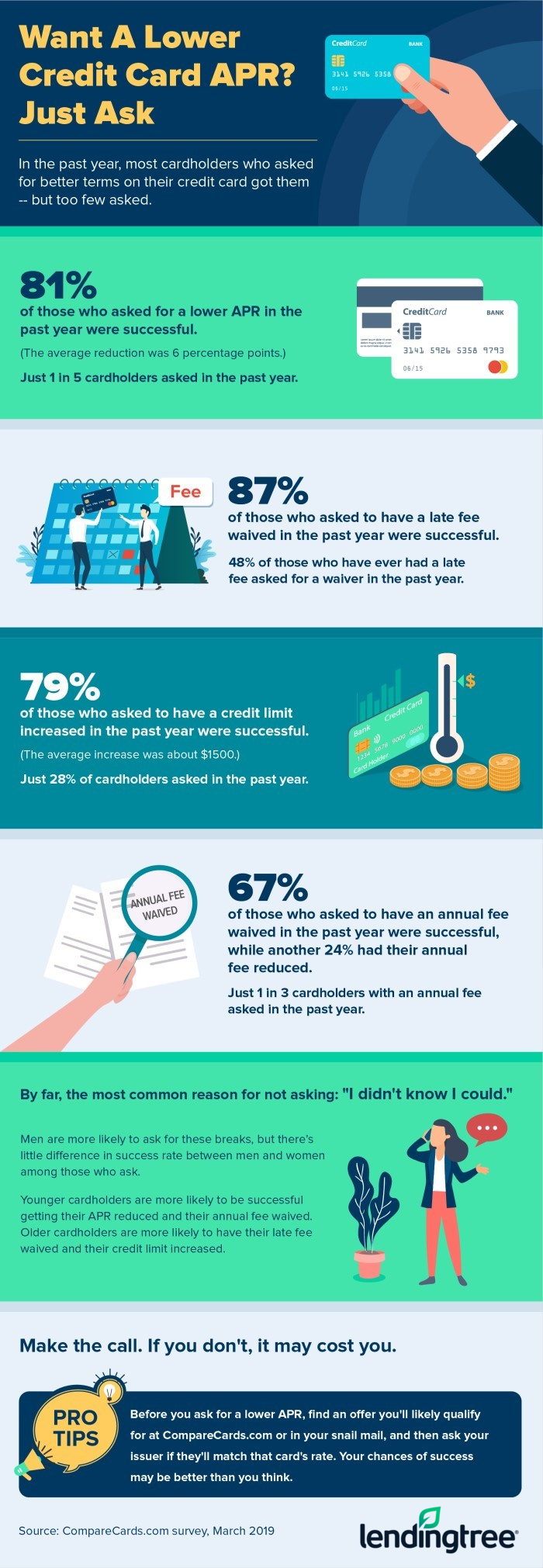

How to reduce credit card interest rates. If you have a good credit score (730 or higher), you can usually negotiate. Finding ways to lower your interest rate can save you money. Credit card interest, and how it’s calculated, can.

You can negotiate a lower interest rate on your credit card by calling your credit card issuer—particularly the issuer of the account you've had the longest—and requesting a. Lower your credit card interest rate lower you credit card interest rates through a debt management plan. Many people don’t understand how credit card apr works.

If you have credit card debt on multiple cards, some personal. Credit cards apply your interest rate—or apr—to your unpaid balance to calculate your interest charges. Pay less interest by making more than your minimum payment due each month.

If you’re looking for ways to reduce your credit card interest rate, here are two options which may help. Many credit cards have high interest rates, but you aren't necessarily stuck paying a fortune. On that same $300,000 loan, a rate of.

Here are some ways to reduce your credit card interest charges: Ask your credit card issuers. On a $300,000 loan, a rate of 3.11% results in a monthly payment of about $1,283, jacob channel, senior economist at lendingtree, said.

Make sure you know how much you owe to your credit card issuers before making a negotiation plan. Negotiate with your credit card company. Once you’ve researched the competition and worked to improve your chances of getting approved for a lower interest rate, it’s time to begin.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)